|

What’s wrong with deficit spending? | |

|

What’s wrong with deficit spending?

“Deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual.” Source: https://en.wikipedia.org/wiki/Deficit_spending Personal deficit spending I’m guessing most Americans have a checking account. As we earn money and deposit the money in a bank, the balance in our checking account grows. When we spend money, the balance in our checking account is reduced by the amount of money spent. This is a pretty simple concept. Almost everybody lives by this rule. However, if we spend more money than is in our checking account, we are notified by the bank that we have insufficient funds. The abbreviation is NSF (non-sufficient funds). Customers are typically charged a premium (penalty) for returned checks and the debtor still owes the original amount. Writing bad checks also damages your credit rating and you can be sent to jail for attempting to defraud someone. Source: https://wallethub.com/edu/bad-check-laws/14289/ Business deficit spending Okay, so there is a penalty for an individual who engages in deficit spending. What about a business? Deficit spending is also illegal for businesses. Penalties are imposed on businesses that engage in deficit spending. A business can be fined, its reputation damaged, loans may not be available, stock share prices will drop, the business can go bankrupt, and its officers may be imprisoned. Some of America’s largest corporations have declared bankruptcy due to non-sufficient funds. For example, “A number of major airlines have declared bankruptcy and have either ceased operations, or reorganized under bankruptcy protection. Airlines, like any business, are susceptible to market fluctuations and economic difficulties. The economic structure of the airline industry may contribute to airline bankruptcies as well. One major element in almost every airline bankruptcy is the rejection by the debtor of its current collective bargaining agreements with employees. After satisfying certain requirements, bankruptcy law permits courts to approve rejection of labor contracts by the debtor-employer. With this tool, airline managers reduce costs. Terms of an employee contract negotiated over years can be eliminated in months through Chapter 11. Terms of the Railway Labor Act, amended in 1936 to cover airlines, prevent most labor union work actions before, during and after an airline bankruptcy.” Source: https://en.wikipedia.org/wiki/List_of_airline_bankruptcies_in_the_United_States City and State government deficit spending What about city and state governments? Are they permitted to engage in deficit spending? The answer is no. However, the penalties for deficit spending are different. When a state or city engages in deficit spending, the bond rating is reduced, the city may declare bankruptcy, elected officials may be put in prison, and the state can appoint a special manager for the debt-ridden city. For example, “The city of Detroit, Michigan, filed for Chapter 9 bankruptcy on July 18, 2013. It is the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion, exceeding Jefferson County, Alabama's $4-billion filing in 2011.” Source: https://en.wikipedia.org/wiki/Detroit_bankruptcy Petersburg, Virginia experienced a budget crisis in 2016. “This city of 32,000 just south of Richmond is facing a financial crisis unusual for fiscally conservative Virginia — or any state. In at least the past four years, the city spent all of its reserves and then kept spending money it didn’t have. It took out short-term loans based on anticipated tax revenue to keep paying bills. When the loans ran out, it stopped paying. Some fire and rescue equipment has been repossessed. The city trash hauler is threatening to stop pickup. And lenders will not give Petersburg any more loans.” Source: https://www.washingtonpost.com/local/virginia-politics/city-on-the-brink-petersburg-cant-pay-its-bills-and-time-is-running-out/2016/09/04/9327c962-6ef9-11e6-8533-6b0b0ded0253_story.html?utm_term=.094f181b9ab9 And here is an example of a state in financial crisis. “Illinois is on the verge of becoming America's first state with a junk credit rating. The financial mess is the inevitable result of spending more on pensions and services than the state could afford -- then covering it up with reckless budget tricks. After decades of historic mismanagement, Illinois is now grappling with $15 billion of unpaid bills and an unthinkable quarter-trillion dollars owed to public employees when they retire. The budget crisis has forced Illinois to jack up property taxes so high that people are leaving in droves. Illinois may soon have to take the unprecedented step of cutting off sales of lottery tickets because the state won't be able to pay winners.” Source: http://money.cnn.com/2017/06/29/investing/illinois-budget-crisis-downgrade/index.html The Federal Government and its deficit I can’t tell you how many times I have heard someone say, “Hey, the Federal Government cannot go broke because the government owns the printing presses and can just print more money!” Let’s see how that has worked in other countries. Inflation in Zimbabwe “From 1991 to 1996, the Zimbabwean Zanu-PF government of President Robert Mugabe embarked on an Economic Structural Adjustment Programme (ESAP), designed by the IMF and the World Bank that had serious negative effects on Zimbabwe's economy. In the late 1990s, the government instituted land reforms intended to evict white landowners and place their holdings in the hands of black farmers. However, many of these "farmers" had no experience or training in farming. From 1999 to 2009, the country experienced a sharp drop in food production and in all other sectors. The banking sector also collapsed, with farmers unable to obtain loans for capital development. Food output capacity fell 45%, manufacturing output 29% in 2005, 26% in 2006 and 28% in 2007, and unemployment rose to 80%. Life expectancy dropped. A monetarist view is that a general increase in the prices of things is less a commentary on the worth of those things than on the worth of the money. This has objective and subjective components:

Over the course of the five-year span of hyperinflation, the inflation rate fluctuated greatly. At one point, the US Ambassador to Zimbabwe predicted that it would reach 1.5 million percent. In June 2008 the annual rate of price growth was 11.2 million percent. The worst of the inflation occurred in 2008, leading to the abandonment of the currency. The peak month of hyperinflation occurred in mid-November 2008 with a rate estimated at 79,600,000,000% per month. This resulted in US$1 becoming equivalent to the staggering sum of Z$2,621,984,228.” Source: https://en.wikipedia.org/wiki/Hyperinflation_in_Zimbabwe Inflation in Venezuela “Inflation in Venezuela is expected to rise by as much as 1500 percent this year amid an economic crisis that has left millions of Venezuelan’s starving and led to mass shortages of basic resources such as food, medicine, and electricity. It is the third increase implemented in Venezuela this year. In January, Maduro raised the minimum wage by 50 percent and then raised it a further 30 percent in April. The new minimum wage stands at 97,531 bolivars a month, which on Venezuela’s official exchange rate equates to around $70 a month but only holds a real market worth of $12.53, according to the unofficial Venezuelan exchange rate service dolartoday.com. People are also provided with a food ticket, which has a black market value of 153,000 bolivars a month, bringing the total monthly minimum income to around $30. As part of his socialist economic program, the late Venezuelan dictator Hugo Chávez boasted that Venezuela had the highest minimum wage in Latin America, equivalent to $372 a month. However, inflation began to soar as early as 2007 and has now reached levels comparable to Germany’s Weimar Republic or Zimbabwe’s hyperinflation crisis, which saw people using wheelbarrows to buy products and the introduction of a 100 trillion dollar banknote. As well as daily violent anti-government protests, instances of mass looting have broken out across the country as people fight for survival. Last week, in Maracay, the capital of Aragua state, people ransacked supermarkets, bakeries, butcher shops and pharmacies of their products.” Source: http://www.breitbart.com/national-security/2017/07/03/venezuela-hikes-minimum-wage-by-further-50-percent-amid-skyrocket-inflation/ What about the United States? Both Zimbabwe and Venezuela are recent examples of excessive government spending. Many people in America choose not to read nor understand this important fact. They falsely believe, “It can’t happen to us.” Oh no? Our national debt is approximately 30 trillion dollars and is growing daily. “The national debt of the United States is the amount owed by the federal government of the United States. In general, government debt increases as a result of government spending, and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. Historically, the US public debt as a share of gross domestic product (GDP) has increased during wars and recessions, and subsequently declined. The ratio of debt to GDP may decrease as a result of a government surplus or due to growth of GDP and inflation. For example, debt held by the public as a share of GDP peaked just after World War II (113% of GDP in 1945), but then fell over the following 35 years. In recent decades, however, aging demographics and rising healthcare costs have led to concern about the long-term sustainability of the federal government's fiscal policies.” Source: https://en.wikipedia.org/wiki/National_debt_of_the_United_States Total US federal government debt breached $30 trillion mark for the first time in history in February 2022. As of February 2023, total federal debt was $31.5 trillion; $24.6 trillion held by the public and $6.9 trillion in intragovernmental debt. In December 2021, debt held by the public was estimated at 96.19% of GDP, and approximately 33% of this public debt was owned by foreigners (government and private). The United States has the largest external debt in the world. The total number of U.S. Treasury securities held by foreign entities in December 2021 was $7.7 trillion, up from $7.1 trillion in December 2020. During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945. In 2013, the U.S. national debt to GDP ratio surpassed 100% when both debt and GDP were approximately $16.7 trillion.[12] On April 28, 2022, the Congressional Budget Office released a report which stated that in order to stabilize the $30 trillion in national debt (i.e. stop the debt from growing relative to the United States economy), it would require that "income tax receipts or benefit payments change substantially from their currently projected path."Source: https://en.wikipedia.org/wiki/National_debt_of_the_United_States Warnings about deficit spending have been announced but our Congress and the President are tone deaf. Intellectually, most of our elected officials know that we Should not spend money that we don’t have but politically, few are willing to risk alienating their public. Psychology of the masses says that once you give voters something ‘for free,’ it’s virtually impossible to take it away from them.

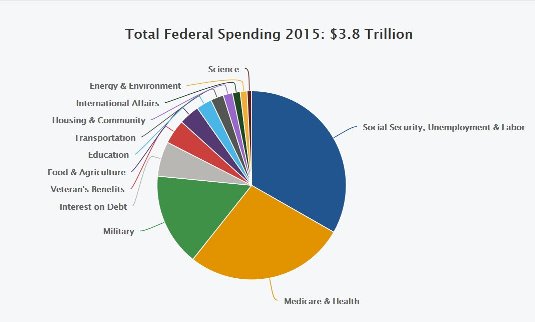

FY 2022 Total Revenue - $4.9 trillion dollars

Are you satisfied with an inflationary economy? If you are on a fixed income, each year your dollars buy less and less. We can fix this by forcing Congress and the President to only spend money earned as revenue. The question remaining is, should we add a balanced budget amendment added to the Constitution?

Joe R. East, Jr. |

||

|

|

||

| Back to Opinion Homepage | ||

| Back to Joe East Homepage | ||

|

Updated 06/09/2023

Joe East - Webmaster |

||